I’m working to pass legislation that supports our families, workers, and students.

Below you will find the bills I sponsored in the 74th General Assembly.

My Legislation.

Navigation

2025 Legislative Highlights

My 2025 Legislation

-

If a prospective family pays a child care center, family child care home, or neighborhood youth organization (child care program) an application fee, a deposit fee, or wait list fee and is not enrolled in the child care program after six months of paying the fee, the act makes the fee is refundable. A child care program may retain a reasonable administrative fee determined by the department of early childhood (department) before issuing a refund to the prospective family. The prospective family must submit a written request to the child care program to receive a refund. Upon receiving the written request from the prospective family, the child care program shall refund the fees to the prospective family and may remove the prospective family from the wait list.

-

Section 1 of the act creates the prescribed fire claims cash fund (fund) in the state treasury and requires the state treasurer to transfer $250,000 from the general fund to the fund on July 1, 2025. Subject to annual appropriation by the general assembly, the division of fire prevention and control (division) shall expend money from the fund to pay claims for damages related to prescribed burns that are certified by the division in accordance with new guidelines as specified in the act and as adopted by the director of the division. The division shall authorize a payment in the amount certified in a claim; except that the maximum payment that the division may authorize for a singular burn is equal to the greater of $20,000 or 10% of the amount of money in the fund at the time the claim is filed.

-

The act requires the division of fire prevention and control, which hosts the wildfire information and resource center website and provides information regarding active wildfires on the website, to include hyperlinks to websites that display emergency information and wildfire updates for each county in Colorado and to coordinate with county governments in order to provide the hyperlinks.

-

On or before September 1, 2025, the act requires the office of school safety (office) to convene and oversee a work group to develop best practices for the use of trauma-informed practices to conduct school safety drills.

The act requires the work group to convene its first meeting no later than 56 days after the office receives $50,000 of gifts, grants, or donations for the purpose of the work group or receives an in-kind donation with a value of $50,000 as part of a public-private partnership agreement. No later than one year and one month after the office receives $50,000 of gifts, grants, or donations or receives an in-kind donation with a value of $50,000, the act requires the work group to develop recommendations to support schools in training school personnel on the use of trauma-informed practices in conducting school safety drills, how to best conduct school safety drills in a trauma-informed manner, and how to best respond to a school safety incident.

-

Dependent upon sufficient gifts, grants, and donations received by the Colorado school of public health (school) and the department of health care policy and financing, the act requires the school to:

Analyze draft model legislation for implementing a single-payer, nonprofit, publicly financed, and privately delivered universal health-care payment system for Colorado that directly compensates providers (analysis);and

Submit a report detailing its findings to the health and human services committees of the house of representatives and the senate by December 31, 2026.

-

Individuals applying for hunting or fishing licenses in Colorado must also purchase a Colorado wildlife habitat stamp. The division of parks and wildlife in the department of natural resources uses the money collected from the Colorado wildlife habitat stamp for the benefit of wildlife habitat or access to wildlife habitat in the state.

The Colorado wildlife habitat stamp program (program) is scheduled to repeal, subject to a sunset review by the department of regulatory agencies, on July 1, 2027. The act continues the program indefinitely.

-

The environmental justice advisory board in the department of public health and environment (advisory board) advises the environmental justice ombudsperson, develops recommendations related to adverse environmental effects on disproportionately impacted communities, and supports the implementation of a grant program to finance environmental mitigation projects. The act adds to the advisory board a voting youth member and a nonvoting youth member, which members are between 14 and 21 years of age.

The act also requires the Colorado energy office (office), on or before December 31, 2025, to develop and post on its website best practices for the adoption and financing of clean energy resources in schools. The office is required to periodically update the best practices and post the updates on its website.

-

The act clarifies that the child of an inbound active duty military member (member) who has an existing individualized education program (IEP) or existing section 504 plan is eligible for open enrollment, remote enrollment, and guaranteed matriculation. The act requires the school district, district charter school, or an institute charter school (local education provider) where the child enrolls to ensure the student receives the appropriate services and accommodations, consistent with the child's existing IEP or section 504 plan, without unreasonable delay upon enrollment.

The act requires each local education provider to take reasonable steps to notify members and their families of their rights, including providing information on special education services to prevent inadvertent exclusion and to ensure members and their families are fully informed of available supports.

-

The act requires each institution of higher education (institution) in Colorado to create and adopt a policy and a process to support the ability of an admitted or enrolled student with a disability (student) to voluntarily self-disclose the student's disability and to engage in an interactive process with the institution to receive an academic adjustment.

The adopted policy must, at a minimum, include information that:

Describes the institution's process to determine whether a student is eligible for an academic adjustment;

Outlines documentation that the institution may request to determine whether a student is eligible for an academic adjustment;

Provides information on the available disability resources and academic adjustments provided to students with disabilities; and

Describes an appeals process for academic adjustment decisions that focuses on documentary review.

Each institution shall publish the policy on the institution's website in an accessible format.

-

The act requires the state board of health (board) to allow the Colorado youth advisory council (council) to present to the board twice a year on issues regarding the youth opioid epidemic and other health issues. The act also allows the council to consult the prevention services division within the department of public health and environment during the stakeholding process for rule-making regarding opioid antagonists.

-

The act implements the recommendation of the department of regulatory agencies in its 2024 sunset review and report on the rural alcohol and substance abuse prevention and treatment program by continuing the program until September 1, 2030.

-

The act requires the department of higher education (department), subject to available appropriations, to develop and maintain a free, publicly accessible online platform (platform) to provide current and potential students who are pursuing postsecondary education in Colorado with relevant information about which credits and courses, work-related experiences, and prior learning opportunities are transferable to or between the state's public institutions of higher education (institution).

-

The act provides immunity from civil liability for damage or injury to persons or property, other than that which arises from gross negligence or willful and wanton misconduct, to a landowner who, in good faith and without compensation, allows access to the landowner's property for entry and exit in connection with an emergency. An emergency is a fire, a rescue call, a hazardous materials incident, a natural or human-caused disaster, or an incident reasonably determined to be an emergency by a first responder.

-

The act encourages each local education provider to adopt a policy to reduce food waste in school cafeterias and food preparation facilities (policy). The policy may address food waste diversion and aversion initiatives, including composting, donation of excess food to local nonprofits, or share table programs that permit students to return whole food or beverage items for redistribution to other students. A local education provider that implements a policy shall comply with all applicable sanitation and health requirements, including protocols to prevent student exposure to allergens, and shall require school personnel to complete related safety training.

-

The act substitutes gender-neutral language for gendered language in title 35, a title concerning agriculture, of the Colorado Revised Statutes. The act also updates archaic language in title 35.

-

The act authorizes the owner of a trailer to register the trailer for as long as the owner owns the trailer. The trailer must be class B or class D personal property. To register the trailer, the owner must pay:

2 years of annual specific ownership tax; and

$55.82 to cover fees.

Upon the transfer of ownership of the trailer, the owner is required to notify the department of revenue of the transfer.

-

The act requires, on or before July 1, 2026, the Colorado school for the deaf and the blind, and each institute charter school, district charter school, and a local board of education for its schools that are not district charter schools, to adopt, implement, and post on its website a policy concerning student communication device possession and use during the school day. At a minimum, the policy must describe the prohibitions and exceptions, if any, regarding student communication device possession and use during the school day.

-

Under current law, certain provisions are required in a public school contract (contract), and if the provisions are omitted from a contract, the law deems that the provisions are automatically included in the contract. The act clarifies that the list includes that a contractor is required to comply with accessibility standards adopted by the office of information technology for an individual with a disability. The act adds a provision to the list to require a contractor to indemnify, hold harmless, and assume liability on behalf of a public school contracting entity, the public school, and the public school's employees and agents, for all remedies for noncompliance with standards that ensure technology accessibility to persons with disabilities.

The act requires that a contract or agreement entered into between a state agency or public entity and a contractor must require a contractor to comply with accessibility standards adopted by the office of information technology for an individual with a disability. Additionally, the contractor must indemnify, hold harmless, and assume liability on behalf of a state agency or public entity's officers, employees, and agents for all remedies for noncompliance with standards that ensure technology accessibility to persons with disabilities. If the provisions are omitted from a contract, the law deems that the provisions are automatically included in the contract.

-

For school districts and the state charter school institute (institute), the act requires the department of education (department) to develop a streamlined format for a performance, improvement, priority improvement, or turnaround plan (plan) that consolidates various state, federal, and grant reporting requirements and allows a school district or the institute to attach a locally developed action portion of the plan that addresses action steps, resources, and any other plan components identified in state board of education (state board) rule.

-

The act repeals the wild horse project and transfers the statutory duties concerning wild horse management and support to the department of agriculture (department). The act repeals and replaces the wild horse stewardship program and the wild horse fertility program with support efforts managed by the department and with an immunocontraception program managed by the department.

My 2025 Special Session Legislation

HB25B-1004 - Sale of Tax Credits

In fiscal year 2025-26, the department is authorized to issue tax credit certificates to qualified taxpayers equal to the lesser of a total face value of up to $125 million or total sales proceeds of up to $100 million, plus any reasonable and necessary administrative, monitoring, and closing costs of the department (closing costs). The minimum proposed tax credit purchase amount must be the greater of either the amount that an independent third party determines to be consistent with market conditions or 80% of the requested dollar amount of tax credits

The act creates the tax credit proceeds cash fund (fund). The proceeds from the issuance of tax credits must be deposited in the fund. Subject to annual appropriation, the department may expend money from the fund for any closing costs associated with implementing and administering the act. Subject to annual appropriation, the department of revenue may expend money from the fund for direct and indirect costs associated with implementing and administering the act. Each month, the state treasurer is required to credit the money generated by the issuance of tax credits to the fund. The department is required to transfer the money in the fund to the general fund, less any amounts used for expenses authorized by the act.

2024 Legislative Highlights

My 2024 Legislation

-

SB24-034 will expand the successful School-Based Health Center Grant Program to include telehealth services and mobile health units. School-based health centers are located in schools throughout Colorado and provide primary medical and behavioral health care to children and young adults. Under current law, the School-Based Health Center Grant Program supports the establishment, expansion, and ongoing operations of school-based health centers. SB24-034 allows this program to work alongside other school-linked programs, such as telehealth and mobile health units.

-

SB24-055 will improve access to behavioral health care in rural Colorado by creating a new Agricultural and Rural Community Behavioral Health program that would work to better connect farmers, ranchers, and their families to behavioral health care. The program will partner with the Colorado Department of Agriculture, health care providers, and directly with agriculture communities throughout Colorado to provide care and support.

-

SB24-064 requires courts to electronically collect data for eviction cases in every county, beginning July 1, 2024. By January 1, 2025, the Judicial Department is required to publish data on all residential evictions online in a searchable format, free of charge and on a monthly basis. The public data does not include personally identifiable information about a landlord or tenant.

-

Colorado's families deserve diverse, accessible childcare options. I sponsored SB24-078 to allow licensure for outdoor nature-based schools (ONBs) and expand their operations. This bill defines ONBs as child care centers for licensing purposes, enabling them to offer full-day programs. It also requires the Colorado Department of Early Childhood to provide training to licensing and ONB program staff. By creating a formal licensure process, we're breaking down barriers for working families, creating job opportunities, and adding an estimated 340 additional spots for children. This innovative approach not only addresses our early-childhood education crisis but also supports students with diverse learning needs.

-

Our rural schools need access to experienced educators and staff. I sponsored SB24-099, which expands the list of PERA service retirees who can work for rural school districts without a reduction in retirement benefits. This bill now includes superintendents and principals, and clarifies that small rural districts with fewer than 1,000 pupils also qualify. By removing barriers to employment, we're addressing critical staffing shortages in our rural schools. This law ensures our rural students have access to quality education by allowing experienced professionals to continue serving their communities without financial penalty.

-

Our parks and wildlife are precious resources that should be accessible to all Coloradans. I sponsored SB24-161, which makes important changes to parks and wildlife licenses and passes. This bill lowers the age for senior fishing licenses to 64, expands eligibility for disabled veterans, and reduces costs for youth hunting licenses. It also allows for better management of our wildlife resources through a potential harvest permit surcharge.

-

Every student deserves to feel safe and respected in school. I sponsored SB24-162 to develop best practices for responding to discrimination and harassment in our schools. This bill requires the Department of Education to work with experts to create these best practices and develop a comprehensive training program. By pushing the implementation deadline to the 2025-26 school year, we ensure schools have time to adopt these thoroughly researched practices. The bill also provides $111,111 for training local education providers. This law is a crucial step towards creating more inclusive and supportive learning environments for all Colorado students.

-

Our county coroners and deputy coroners provide a crucial public service. I sponsored SB24-186 to reclassify these officials as state troopers within the Public Employees' Retirement Association (PERA) system. Starting January 1, 2025, coroners and deputy coroners elected, reelected, or appointed since January 1, 2021, will be eligible for the same retirement benefits as state troopers. This change recognizes the demanding nature of their work and ensures they receive appropriate retirement benefits. By improving benefits for these essential public servants, we're supporting their dedication to our communities and helping counties retain experienced professionals in these critical roles.

-

I sponsored SB24-226 to expand and improve the College Kickstarter Account Program. This bill broadens access by allowing any individual, not just parents, to open an account for an eligible child starting January 1, 2025. It extends the claim period for kickstarter funding from 5 to 8 years after a child's birth or adoption, giving families more flexibility. The bill also ensures the kickstarter amount grows with inflation and accrues interest. By expanding the program's advisory board and enhancing reporting requirements, we're making sure this program evolves to meet the needs of Colorado families. These changes will help more children build savings for their education and brighten their future prospects.

-

Access to quality mental health care is crucial for Coloradans. I sponsored HB24-1002, enacting the Social Work Licensure Compact. This law streamlines the licensing process for social workers across member states, making it easier for them to practice where they're needed most. It enhances accountability by allowing member states to enforce their standards on visiting practitioners. The compact also facilitates telehealth services, improving access to mental health care, especially in underserved areas. By joining this compact, we're removing barriers for social workers and expanding mental health resources for our communities.

-

When disaster strikes, homeowners need quick access to insurance funds to rebuild. I sponsored HB24-1011 to ensure mortgage servicers promptly and fairly disburse insurance proceeds to borrowers whose homes are damaged or destroyed. This law requires servicers to approve repair plans within 30 days and disburse funds within 14-30 days of receiving insurance proceeds. It mandates transparent communication about the disbursement process and sets clear timelines for fund release. The bill also protects borrowers by requiring excess funds to be returned promptly and ensuring any held funds earn interest for the homeowner. By streamlining this process, we're helping Colorado families recover faster from property damage and natural disasters.

-

Every dollar counts for college students. I sponsored HB24-1018 to make higher education more affordable by exempting college textbooks from state sales and use tax, starting July 1, 2024. This law reduces the financial burden on students and their families by lowering the cost of essential educational materials.

-

I sponsored HB24-1039 to ensure that schools honor students' chosen names. This law requires school personnel to use a student's chosen name in school and during extracurricular activities. It defines intentional refusal to use a student's chosen name as discrimination, allowing affected students to file reports or federal civil rights complaints. The bill also mandates that schools implement written policies on honoring students' name choices. By protecting students' right to be addressed as they choose, we're creating more inclusive, supportive learning environments where all students can thrive.

-

Our schools need more, qualified special education teachers. I sponsored HB24-1087 to create an additional pathway for educators to gain special education endorsements. This law allows teachers with professional licenses to obtain special education endorsements through alternative teacher preparation programs, not just traditional higher education routes. It also permits teachers to continue in their current positions while pursuing this endorsement. By expanding pathways to special education certification, we're addressing the critical shortage of special education teachers in Colorado.

-

Our students deserve access to quality mental health support. I sponsored HB24-1096, enacting the School Psychologists Licensure Interstate Compact. This law creates a pathway for school psychologists to practice across member states, improving access to these crucial services in our schools. By streamlining the licensure process, we're making it easier for qualified professionals to work where they're needed most. The compact also includes provisions for active military members and their spouses, supporting those who serve our country.

-

Colorado's unique ecosystems deserve comprehensive protection. I sponsored HB24-1117 to expand our state's conservation efforts to include rare plants and invertebrates. This law renames our conservation act to the "Nongame, Endangered, or Threatened Wildlife and Rare Plant Conservation Act," reflecting its broader scope. It empowers the Division of Parks and Wildlife to undertake voluntary programs to conserve and protect invertebrates, filling a crucial gap in our ecosystem management.

-

Colorado's workers deserve fair and comprehensive support when injured on the job. I sponsored HB24-1220 to modernize and improve our workers' compensation system. This law allows injured workers to refuse modified employment that requires driving if their doctor has restricted them from doing so. It adds the loss of an ear to the list of injuries eligible for whole person permanent impairment benefits. Importantly, it significantly increases the benefit limits: up to $185,000 for impairment ratings of 19% or less, and up to $300,000 for ratings above 19%. The bill also requires insurers to offer direct deposit for benefit payments upon request. These changes ensure our workers' compensation system better meets the needs of injured workers, providing more comprehensive coverage and convenient payment options.

-

Access to quality child care is crucial for Colorado families. I sponsored HB24-1237 to create three innovative programs that will boost child care facility development across our state. This law establishes a toolkit and technical assistance program to help providers and communities plan and build child care facilities. It also creates a planning grant program for local governments to update regulations supporting child care development. Additionally, it introduces a capital grant program to fund the construction and renovation of child care facilities. With $250,000 in initial funding and the potential for additional resources, we're making a significant investment in expanding child care access.

-

Every student deserves to feel safe and respected at school, regardless of their physical appearance. I sponsored HB24-1285 to address a serious form of bullying that often goes unrecognized. This law adds patterns of bullying based on a student's weight, height, or body size to the prohibited behaviors in school district and charter school discipline policies. By explicitly including these forms of bullying, we're sending a clear message that targeting students for their physical appearance is unacceptable. This expansion of anti-bullying policies will help create more inclusive and supportive learning environments, ensuring all students can focus on their education without fear of harassment.

-

Every student deserves a safe and comfortable learning environment. I sponsored HB24-1307 to ensure our schools have proper heating, ventilation, and air conditioning (HVAC) systems. This law sets stringent requirements for HVAC improvements in schools when using federal or combined federal and state funds. It mandates thorough assessments, professional reviews, and regular maintenance of HVAC systems. The bill also ensures only certified contractors perform this crucial work. To support our schools, it allows them to apply for grants for these projects and provides grant writing and administrative support through the Governor's office.

-

The safety of our educators is paramount to maintaining quality education in Colorado. I sponsored HB24-1320 to create the Educator Safety Task Force, bringing together diverse perspectives to address crucial safety issues in our schools. This task force will review laws affecting staff safety, examine the impact of staff shortages on student behavior, and investigate incidents of aggressive behavior towards educators. It will also consider how funding, resource inequality, and lack of wraparound services affect learning environments. By June 30, 2025, the task force will provide recommendations to key education stakeholders and policymakers. With an appropriation of $146,250, we're investing in finding comprehensive solutions to ensure our educators can focus on teaching in safe, supportive environments.

-

Maintaining high professional standards in architecture, engineering, and land surveying is crucial for Colorado's safety and development. I sponsored HB24-1329 to continue the state board of licensure for these professions for another nine years, until 2033. This bill implements key recommendations from the 2023 sunset review, enhancing the board's effectiveness. It strengthens disciplinary processes, updates examination references, and grants the board authority to establish continuing education requirements. We've also modernized the law by removing citizenship and residency requirements for board members and replacing gendered language with inclusive terms. These changes ensure our licensing system remains robust and adaptable, supporting both professionals and public safety in our rapidly growing state.

-

Agriculture is a vital part of Colorado's heritage and economy. I sponsored HB24-1369 to create a special Colorado agriculture license plate, allowing Coloradans to show their support for our farming and ranching communities. For a one-time additional fee of $25, drivers can proudly display this plate on their vehicles. The funds generated will be credited to the highway users tax fund, supporting our state's transportation infrastructure. This bill not only celebrates our agricultural roots but also provides a new revenue stream for road improvements. With appropriations totaling over $33,000 to implement the program, we're investing in both our agricultural pride and our transportation future.

-

Safe, healthy housing is crucial for all Coloradans, especially in our rural communities. I sponsored HB24-1457 to create a pilot grant program helping rural local governments tackle dangerous asbestos and lead paint in housing and development projects. Starting July 1, 2025, this program will award grants to offset abatement costs, making renovations and new developments safer and more feasible. The program is funded by up to $200,000 annually from penalties and fines related to hazardous materials violations. By providing this crucial support, we're not only improving public health but also encouraging rural development and revitalization. This initiative demonstrates our commitment to the safety and growth of Colorado's rural communities.

2023 Legislative Highlights

My 2023 Legislation

-

The bill allows school districts to employ licensed mental health professionals who are not licensed by the Department of Education. These professionals may be supervised by either a mentor in the professional field in which they are licensed or by a school district administrator. School districts must conduct a fingerprint based criminal history background check of these additional employees.

-

This bill encourages each public school in the state to provide instruction on cardiopulmonary resuscitation (CPR) and the use of an automated external defibrillator to students in grades 9 through 12.

-

This bill eliminates the requirement that the department of education administer a state assessment in social studies to elementary and secondary students, returning valuable instructional time back to our students.

-

This bill continues the Colorado Youth Advisory Council, giving Colorado’s youth an opportunity to directly shape the State Government.

-

With this bill, public and nonprofit employees will qualify for federal loan forgiveness after ten years of making student loan payments. This bill applies a multiplier of 4.35 to each hour of direct instruction to accurately reflect the full time work, allowing part time or adjunct instructors to qualify for the loan forgiveness program.

-

As an alternative route to teacher licensure, the bill creates a teacher degree apprenticeship program, which builds on elements of current alternative teacher licensure programs, including a bachelor's degree requirement, training programs approved by the state department of education (CDE), and structured on-the-job training.

-

This bill would improve homeowner protections by ensuring that the interest rate on debt issued to a metro district is at or below market rates, if one of the district’s directors has a potential conflict of interest. The bill also requires a metro district to include the maximum mill levy it will assess and total debt it can incur in the original proposal, providing greater transparency and property tax certainty for property owners

-

The bill implements the recommendation of the department of regulatory agencies in its sunset review and report on the state noxious weed advisory committee to continue the advisory committee. The bill continues the noxious weed advisory committee until September 1, 2034.

-

The bill makes it a deceptive trade practice to directly or indirectly advertise abortions, emergency contraceptives, or referrals for these services when the person does not provide these services. The bill also makes it unprofessional conduct for a regulated health care professional to provide, prescribe, administer or attempt medication abortion reversal.

-

This bill updates the exception to specify that agricultural land may be included in an urban renewal area if the agricultural land is in an existing urban renewal plan, the urban renewal plan was originally approved or modified to include the agricultural land prior to June 1, 2010, and if the land still remains in that same urban renewal plan.

-

This bill requires that public schools adopt a formal policy protecting students from harassment or discrimination, train staff annually, and collect and pass data on reported incidents to school districts and the state.

-

The Commercial Property Assessed Clean Energy Program (C-PACE) allows certain property owners to obtain financing for new energy improvements, which under current law include energy efficiency improvements and renewable energy improvements. The bill expands the scope of the program to include resiliency and water efficiency improvements, such as addressing structural integrity, indoor air quality, and storm water control.

-

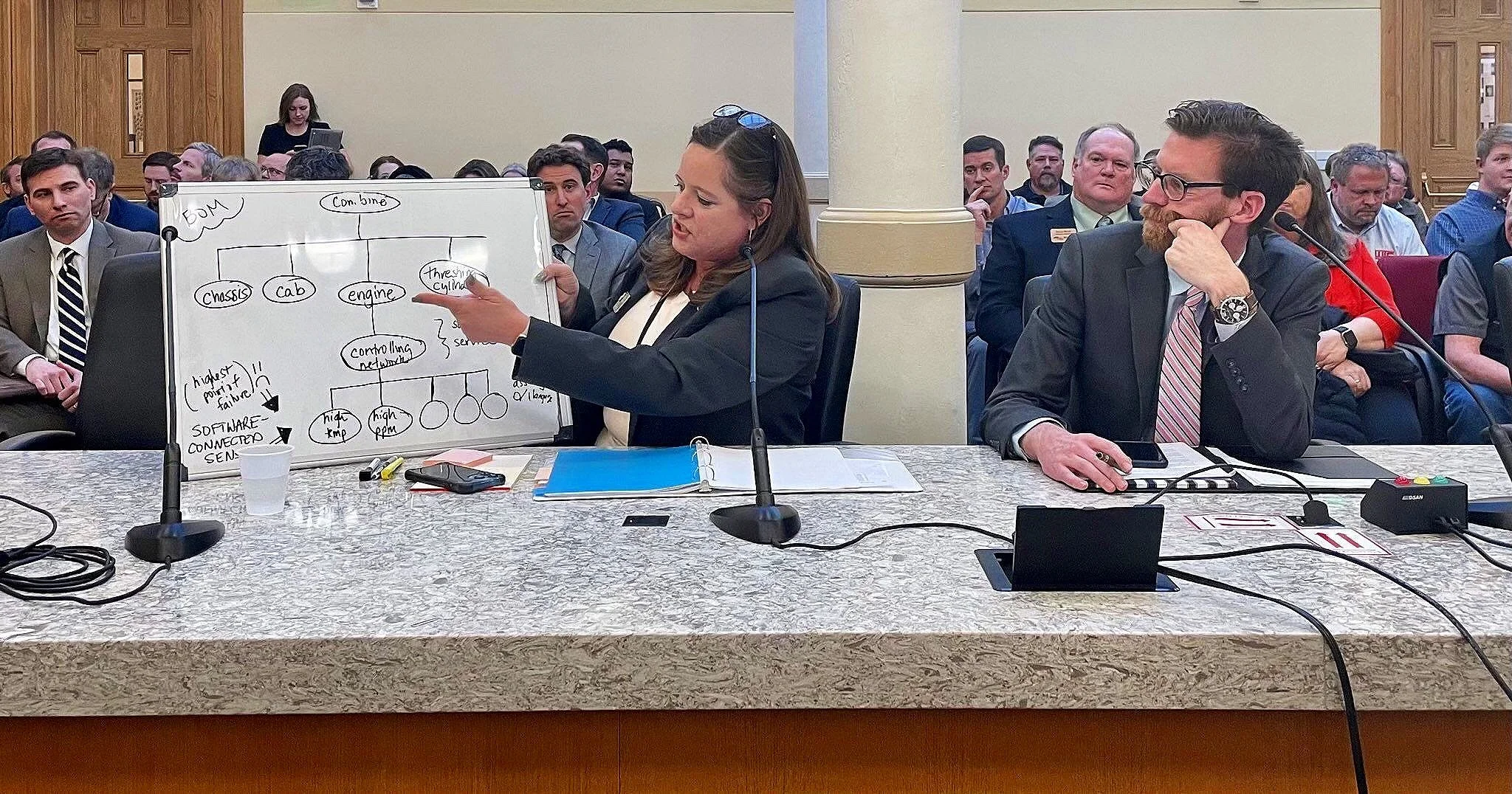

The bill adds agricultural equipment to the existing consumer right-to-repair statutes. It requires a manufacturer to provide necessary parts, software, firmware, tools, or documentation to independent repair providers and owners at a fair and reasonable price. The bill specifies that fair and reasonable price for these items cannot be greater than the suggested retail price indicated by the manufacturer or a dealer selling on behalf of the manufacturer. The bill creates a deceptive trade practice for manufacturers that do not comply with the requirements of the bill.

-

The bill enacts the Interstate Teacher Mobility Compact, which allows licensed teachers in a member state to more easily obtain a teacher’s licenses from another member state. The compact takes effect when ten states have enacted the compact.

The bill requires the state to compile and maintain a list of eligible licenses that the state is willing to consider for equivalency under the compact. When a state receives an application for licensure by a teacher with an eligible license in good standing, it must determine which eligible licenses the teacher is eligible for and grant the license after completion of a background check and any other requirements.

-

The bill expands the jurisdiction of the Independent Ethics Commission in the Judicial Department to include public officials and employees of school districts and special districts. Complaints to the commission may include any ethical issue arising under the constitution, or under the code of ethics as proscribed by current law for employees and officials of local governments.

-

The bill requires the Office to Future of Work in the Department of Labor and Employment (CDLE) to solicit a vendor contract, through a competitive process, for a study to evaluate the skill transferability of workers in the oil and gas industry and in occupations in Colorado facing disruption due to automation and technological development. The bill specifies that the study must make policy recommendations, consult with relevant stakeholders, evaluate and analyze current funding sources available for workforce development, identify transferable skills and emerging industries, and identify ways to remove barriers to obtaining appropriate skills and licenses. The study must be completed on or before December 1, 2024, and a report submitted to the Governor’s Office and relevant legislative committees.

-

The state child care contribution tax credit is currently available through tax year 2024 to taxpayers who make a monetary contribution to promote child care in Colorado. The credit is nonrefundable, meaning that the amount claimed cannot exceed a taxpayer’s income tax liability for a given year. The credit is equal to the lesser of 50 percent of the total contribution, up to $100,000 per taxpayer per year or the taxpayer’s actual income tax liability. Qualifying contributions include those to facilities, schools, or programs that provide child care, programs that train child care providers, and grant or loan programs for parents requiring financial assistance for child care purposes.

This bill extends the credit through tax year 2027.

-

Under current law, faculty at institutions of higher education are allowed to take a sabbatical if approved by the governing board of the institution. The bill extends this privilege to staff members of the institution who serve in a management position, including a director up to a vice president.

-

The bill updates the process of changing groundwater well owner information. Under current law, a groundwater well owner must file any name or mailing address change with the State Engineer in person, by mail, or by fax. Current law also requires that when a change of ownership occurs, any required forms must be submitted before the change in ownership transaction. The bill modifies these requirements by:

removing the in person, by mail, or by fax requirement; and

requiring any necessary forms to be submitted within 63 days after a change in ownership transaction occurs.

-

This bill is a huge investment in our K-12 schools and does the following:

$25 million for three-year grants for after-school math and STEM improvement. School districts, Boys and Girls Clubs and other community groups, and individual charter schools could apply for tutoring programs.

Free optional training for an estimated 36,000 educators in the latest evidence-based math practices. Parents could also tap into training. The Colorado Department of Education would create a free “train the trainer” model and provide technical assistance in math instruction to specifically help small rural districts and for high-quality math curricula. Training would include interventions for students with disabilities, students below grade level and English-language learners.

Required education preparation programs to train their new teachers in evidence-based math instruction. That includes interventions to help students who are below grade level, children with disabilities and English-language learners.

Encourage school districts to identify students who are struggling in math, notify parents, and offer interventions to assist with math at home. A targeted focus would be on ninth graders as they transition into high school.

Require preschool teachers to educate young children in basic early numeracy.

Purchase a master license for a digital online math accelerator tutoring program that could offer personalized instruction to every elementary and middle school student in Colorado.

-

The bill requires that the Colorado Department of Education (CDE) ensure that standardized tests are administered to the minimum extent practicable while still assessing the academic achievement of students. If necessary, the CDE must apply to the federal Department of Education (DOE) for a waiver of state testing requirements. The waiver application may propose shorter testing, a sampling model, or other alternative strategies.

-

The bill removes the requirement that the any inspection, testing, and quarantine of livestock occur pursuant to any rules promulgated by the Commissioner of Agriculture. The bill shifts the authority to issue an order of condemnation in cases where there is an outbreak of contagious or infectious diseases among livestock from the State Agricultural Commission to the Commissioner of Agriculture, in collaboration with State Veterinarian and the Governor.

-

The bill creates the Born to Be Wild special license plate. By January 1, 2024, the license plate will be available to applicants who pay an annual $50 fee credited to the Wildlife Cash Fund, two one-time special license plate fees of $25, and standard license plate fees. The Division of Parks and Wildlife will use money from the annual fee for nonlethal methods of mitigating and preventing human conflict with gray wolves, including programs and training, deploying equipment and technology, supporting relevant research, and promoting and marketing the plate.

My 2023 Special Session Legislation

SB23B-003 - Flat TABOR Refunds:

Providing TABOR refunds in equal amounts for every Coloradan will improve equity by putting more money back into the pockets of the people who need it the most. If we do nothing, the wealthiest Coloradans will receive the largest refunds. Making this change means hardworking people in Colorado will get a larger refund.

SB23B-003 puts more money back into the pockets of Coloradans, and would increase TABOR refunds by about $500 for the majority of working families by creating a new temporary refund mechanism - identical to what Democrats provided last year - that replaces the sales tax refund mechanism for FY 22-23. Every Colorado taxpayer will receive an identical refund payment, making our tax code more equitable and providing enhanced support for working families.